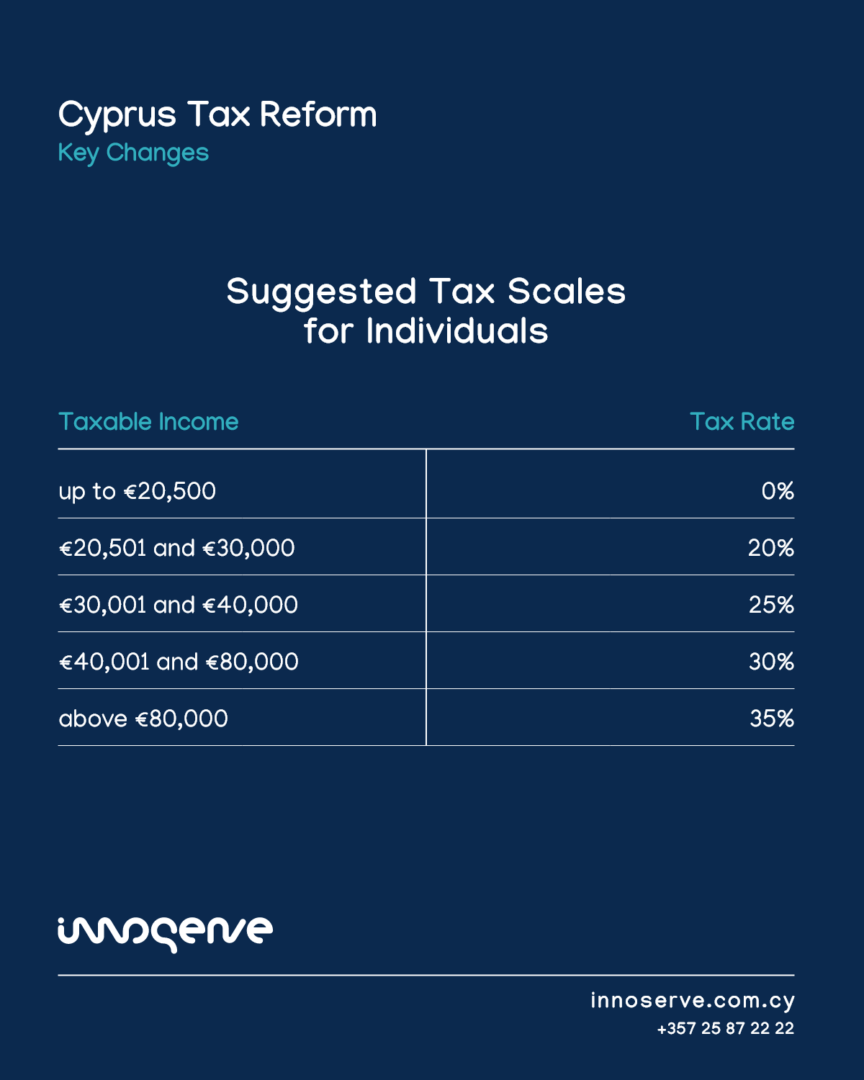

Cyprus Tax Reform: Suggested Tax Scales for Individuals

The recent overhaul of Cyprus’s personal income tax system is still under discussion, however, the proposed changes promise to modernize the tax framework and provide relief to many taxpayers. The new structure of tax brackets is designed to ensure greater fairness, stimulate consumer spending, and foster overall economic growth. The reform is expected to take effect on January 1, 2026, though final rates may be revised before official implementation.

Under the proposed system, individual income would be taxed according to the following progressive brackets:

- 0% for income up to €20,500:

Individuals earning €20,500 or less annually would not pay any income tax, effectively easing the burden on low-income earners and promoting disposable income among households at the lower end of the wage spectrum. - 20% for income between €20,501 and €30,000:

This bracket introduces a moderate tax rate of 20%, designed to gradually introduce higher rates as incomes rise so that those with slightly higher earnings contribute a fair share while still maintaining a manageable tax load. - 25% for income between €30,001 and €40,000:

With an increase to a 25% rate for this income segment, the system continues its progressive nature, seeking to balance revenue needs without overburdening middle-income earners. - 30% for income between €40,001 and €80,000:

Individuals earning between €40,001 and €80,000 would be taxed at 30%. This rate reflects a commitment to a graduated scale that increases tax contributions as income rises, without an abrupt leap that might discourage higher earnings. - 35% for income above €80,000:

Notably, the highest rate of 35% would apply only to incomes exceeding €80,000—a shift from the previous threshold of €60,000. This change delays the application of the top rate, offering relief to many high earners and aligning Cyprus’s tax policy more closely with European standards.

Please note that the above information are based on the Economics Research Centre’s presentation. Additional details regarding the proposed measures have not been made available at this time.