Cyprus Tax Reform: Corporate Tax

As part of a broader tax reform initiative, Cyprus is set to implement significant changes to its corporate income tax system. These measures aim to align the country’s tax framework with international standards while maintaining its appeal as a business-friendly jurisdiction.

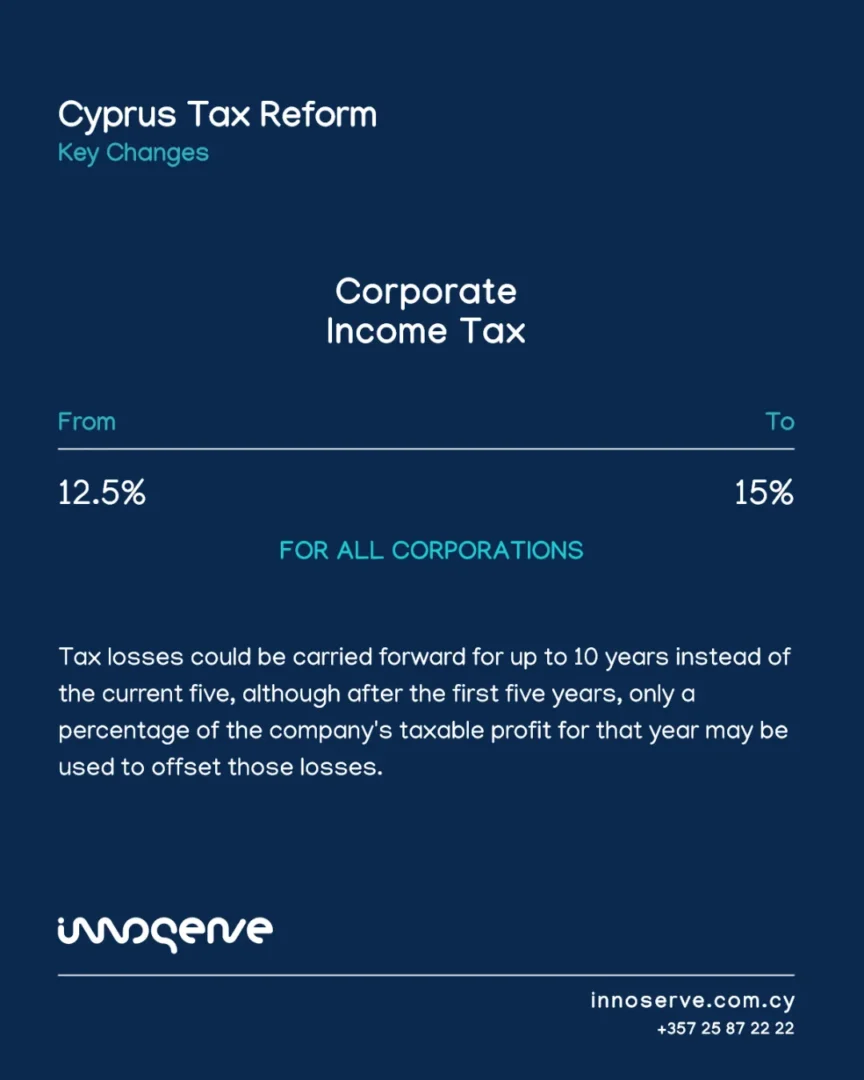

One of the key proposals is an increase in the corporate income tax rate from 12.5% to 15%. This adjustment is designed to bring Cyprus in line with the OECD’s global minimum tax rate framework, ensuring compliance with international tax developments. While this change means a slightly higher tax burden for businesses, Cyprus remains one of the more competitive tax jurisdictions in Europe.

In a move to support businesses, the reform also proposes extending the tax loss carry-forward period from five to ten years. This allows companies to offset their losses against future profits for a longer period, providing financial flexibility and easing the impact of temporary downturns. However, conditions may apply, particularly for loss utilization beyond the initial five-year period.

These tax changes are expected to take effect from January 1, 2026, subject to final approval.