Understanding AML and Its Impact on Businesses

AML, short for Anti-Money Laundering, is a crucial concept in the financial and business world. Understanding its implications is essential for businesses of all sizes.

What Does AML Mean?

AML refers to a set of laws, regulations, and procedures designed to prevent individuals and entities from disguising illegally obtained funds as legitimate income. It’s primarily aimed at combating money laundering, a practice where criminal proceeds are transformed into ostensibly legitimate money or other assets.

Key Components of AML:

- Know Your Customer (KYC): Businesses are required to verify the identity of their clients, understand their business activities, and assess their risk profiles.

- Transaction Monitoring: Regular monitoring of financial transactions to identify suspicious activities that could indicate money laundering.

- Reporting: Obligation to report suspicious transactions to the relevant authorities.

- Compliance Programs: Developing internal policies, procedures, and controls to detect and report money laundering activities.

How AML Affects Businesses:

- Compliance Costs: Implementing AML procedures involves costs. Businesses must invest in systems to monitor transactions and in training staff to recognize suspicious activities.

- Reputational Risk: Non-compliance can lead to legal penalties and damage to the business’s reputation. Customers and partners are less likely to engage with a company that is perceived as non-compliant.

- Operational Impact: AML measures can impact the speed and efficiency of business operations. The need for thorough customer due diligence can slow down onboarding processes and financial transactions.

- Financial Penalties: Failure to comply with AML regulations can result in hefty fines. Regulatory bodies worldwide have been increasingly imposing significant penalties on businesses that fail to meet AML standards.

- International Business Considerations:

- For businesses operating globally, AML compliance becomes more complex due to varying regulations in different jurisdictions. Understanding and adhering to international AML standards is crucial.

- Enhanced Customer Trust: On the positive side, robust AML practices can enhance a business’s credibility and trust among clients and financial institutions.

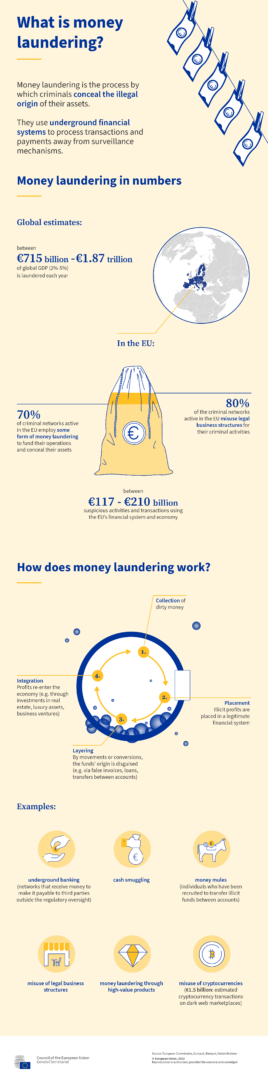

Infographic – What is money laundering

Source: https://www.consilium.europa.eu/en/infographics/anti-money-laundering/

In summary, while AML compliance poses challenges and costs for businesses, it’s an essential aspect of operating in today’s global economy. Effective AML strategies not only help in preventing financial crime but also safeguard the business’s reputation and ensure long-term operational sustainability. Therefore, businesses must proactively address AML obligations to remain compliant and competitive.